Effect of Currency Exchange Rates on the Stock Market

We frequently see news headlines stating that the rupee has either fallen or risen against the buck. Have you ever wondered what it means when the rupee strengthens or weakens, how it impacts the market, and how that affects our investments?

A nation’s currency is a very volatile investment. It varies based on several variables, including the rate of interest, inflation, geopolitical stability, trade balance, national debt, and the state of the economy. Let’s find out how this volatile asset can affect the stock market.

Unraveling the underlying relationship between the currency exchange rates on the stock market

The underlying idea is that when the domestic stock market increases, it offers investors hope that the nation’s economy will follow suit, increasing interest from overseas investors and driving up demand for the local currency. If the stock market underperforms, on the other hand, investor confidence plummets, and foreigners return their money to their home currencies.

It is predicated on the notion that the state of the domestic currency may significantly impact the market value of businesses. As a nation’s currency weakens, its exported goods become less expensive abroad, which can support growth and result in a possible rise in profits for businesses whose revenue is reliant on exports.

Thus, when the buck strengthens, it ends up lowering the stock prices in an emerging market like India. This is because when the buck’s value strengthens, everything in the emerging markets economy appears inexpensive, including the cost of the stocks. Similarly, when the emerging market currency falls and the cost of overall imports increases, all companies that depend on imports would be negatively affected, and the stock prices might be affected.

What is the impact on mutual funds?

Any currency shift is a critical factor in determining how your investment in the mutual fund will perform if you have opted to invest in a specific mutual fund wherein the fund management team has decided to invest in international bonds or stocks. In that matter, your global investment in mutual funds would appreciate an increase in value if the buck strengthened. Similarly, your investment can lose value if the value of the buck declines.

What about domestic investments?

Even if you solely own local assets and no international investments, you would still be subject to the global market’s currency peril. Many corporations listed on the secondary market have assets in foreign firms; if the value of that nation’s currency falls, your investments may also suffer.

Should you be worried about your investments in the domestic market?

If you have invested in a stock/company that is heavily dependent on foreign currency, the company would have taken necessary measures to hedge its position. This is to ensure that the company can handle the loss. For example, most IT companies have a significant chunk of their revenue coming from US and UK. They also undertake adequate hedge positions to ensure that they do not suffer a considerable loss upon the exchange currency swaying on either side.

While your investments may suffer a little on an intermediate basis, if you are a long-term investor, then you need not worry, as the intermediate jerks will be ironed out. Also, you may choose the systematic investment route to achieve rupee cost averaging, thus ensuring that you buy more on dips and lower on peaks bringing down the average cost. This is one means of reducing peril.

There are companies that gain when the rupee strengthens and those when it weakens. Investing across both types of companies will reduce your overall peril. Also diversifying your investment will also be effective.

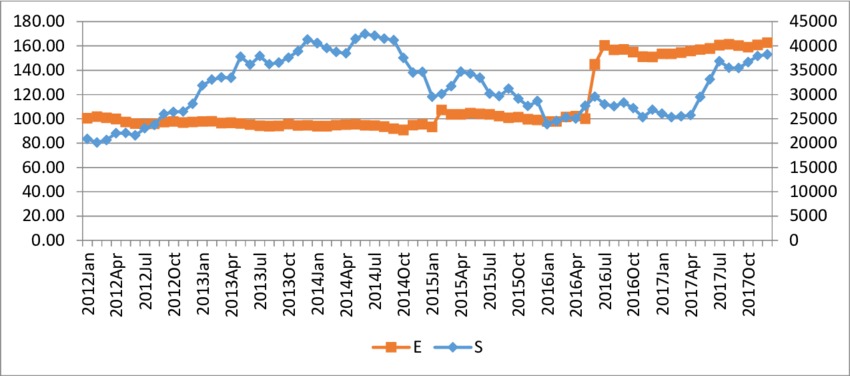

Although no definitive relationship is proven between the foreign currency exchange rate and the domestic stock market, there are quite a few correlations between the two wherein a change in one leads to a change in the other, whether positively or negatively.

To wrap it up:

When choosing what to trade and when to trade it. While the forex market might be an intriguing aspect to take into account when examining equities, more is needed to offer a reliable appraisal of market movements. It should be one of the many aspects to consider whilst evaluating an investment.

Leave a Reply